Articles

Sep 18, 2024

18 Greatest Competing Businesses of All Time

Let's look at the fiercest competitions over time: from Coke vs. Pepsi, Nike vs. Adidas, and more.

Introduction to Competing Businesses

Competition is the driving force behind innovation, efficiency, and progress in business. It's not just about outselling rivals; it's about creating value, differentiating offerings, and evolving to meet changing consumer needs. In fact, 84% of businesses claim that their market has become more competitive in the past three years, highlighting the intensifying nature of business rivalries.

Understanding how to deal with competitors is crucial for survival and growth. It's about anticipating moves and charting a unique course. This proactive approach is why 90% of Fortune 500 companies use competitive intelligence to gain an advantage.

A truly competitive business goes beyond mere profitability. It's about the ability to innovate, adapt to market changes, and consistently deliver value to customers. These businesses thrive under pressure, using competition as a catalyst for growth and improvement.

Classic Rivalries: A Closer Look at Notable Case Studies

Open AI vs Microsoft vs Anthropic

In the AI world, a new rivalry has emerged between OpenAI, Microsoft, and Anthropic. Each company is vying for supremacy in language models and AI applications. OpenAI pioneered large language models with its GPT series. Microsoft integrated AI into products like Bing and Office. Anthropic, founded by former OpenAI researchers, positions itself as a more ethical alternative with its AI model, Claude.

Blockbuster vs. Netflix

The Blockbuster vs. Netflix rivalry is a cautionary tale of innovation and adaptability. Blockbuster's brick-and-mortar model was disrupted by Netflix's mail-order DVD service and later, its streaming platform. This showcases how technological shifts can rapidly change industry dynamics.

Marc Randolph, co-founder and former CEO of Netflix, often recounts a pivotal meeting in 2000 that encapsulates this rivalry. Randolph and co-founder Reed Hastings traveled to Blockbuster's Dallas headquarters to propose a partnership. They offered Blockbuster a 49% stake in their three-year-old business for $50 million. John Antioco, Blockbuster's then CEO, essentially laughed them out of the room.

Randolph vividly remembers Antioco's reaction:

"I saw something new, something I didn't recognize, his earnest expression slightly unbalanced by a turning up at the corner of his mouth. It was tiny, involuntary, and vanished almost immediately. But as soon as I saw it, I knew what was happening: John Antioco was struggling not to laugh."

This rejection is widely regarded as one of the biggest mistakes in business history. Today, Netflix has a market cap of over $150 billion, while Blockbuster is defunct, having filed for Chapter 11 bankruptcy protection in 2010. Only a single Blockbuster franchise store remains, located in Bend, Oregon.

Clayton Christensen, renowned author of "The Innovator's Dilemma," regarded Netflix as a prime example of disruptive innovation. In 2015, Christensen wrote that Blockbuster's decision to ignore Netflix might have been justified initially, as the two companies catered to different customer groups. Netflix's DVD-by-mail service appealed to specific customer segments like movie buffs, early adopters of DVD players, and online shoppers.

However, as new technologies allowed Netflix to transition to streaming video over the internet, the company became appealing to Blockbuster's core customers. Netflix's disruptive path from the fringes to the mainstream eroded Blockbuster's market share and profitability.

James Keyes, who replaced Antioco as CEO in 2007, maintains that he would have made the same decision if he'd been at the meeting.

"All Netflix had in 2000 was DVDs by mail, which was absolutely something that Blockbuster could replicate on its own," he recalls. "There really wasn't a strategic advantage [to investing]."

However, Randolph believes the crucial lesson to be learned from this experience is the importance of self-disruption. "If businesses are unwilling to disrupt themselves, there will always be someone else willing to disrupt them," he notes. This principle has become a cornerstone of many successful tech companies' strategies, including Facebook, which included in its company values the idea that if it failed to create the next big thing that could potentially replace Facebook, someone else would.

Coca-Cola vs. Pepsi

The "Cola Wars" between Coca-Cola and Pepsi have raged for over a century, spawning iconic marketing campaigns and blind taste tests. Their rivalry has driven innovation in flavors, packaging, and marketing strategies.

Interestingly, a 2022 study of cola brands in Great Britain revealed that Coca-Cola remains the most popular, with an estimated 13.75 million consumers. Pepsi Max ranked second with 9.93 million consumers, followed closely by Diet Coke with 9.52 million.

Apple vs. Microsoft

The rivalry between Apple and Microsoft is one of the most iconic in the tech industry, shaping the landscape of personal computing and beyond for decades. This competition exemplifies how different approaches to innovation, marketing, and corporate culture can lead to success in the highly competitive tech market.

Apple, founded in 1976 by Steve Jobs and Steve Wozniak, has built its reputation on sleek design, user-friendly interfaces, and a closed ecosystem. Microsoft, established by Bill Gates and Paul Allen in 1975, became dominant through its operating system and business software, focusing on widespread adoption and an open ecosystem for third-party developers.

Key aspects of their rivalry include:

Innovation and R&D

Apple has consistently increased its R&D spending, reaching $18.7 billion in 2020. This investment has led to groundbreaking products like the iPhone, iPad, and Apple Watch.

Microsoft also invests heavily in R&D, spending $19.3 billion in 2020. Their focus has been on cloud computing, artificial intelligence, and expanding their software ecosystem.

Both companies have impressive patent portfolios, with Apple being awarded 2,792 patents in the United States in 2020 alone.

Market Strategy

Apple follows a "knowing more" strategy, focusing on predicting and shaping consumer needs. They create products that consumers didn't know they wanted, often leading to new market categories.

Microsoft, under Steve Ballmer's leadership, adopted a "doing more" approach, emphasizing product volume and market share. However, this strategy has evolved under current CEO Satya Nadella, with a renewed focus on cloud services and AI.

Corporate Culture and Structure

Apple maintains a secretive, design-focused culture with a flat organizational structure where experts lead in their domains.

Microsoft has transformed its culture under Nadella, moving away from internal competition to foster more collaboration and innovation.

Product Ecosystem

Apple's closed ecosystem integrates hardware, software, and services, creating a seamless user experience and high customer loyalty.

Microsoft's open ecosystem allows for wider adoption and third-party innovation but can lead to fragmentation and inconsistent user experiences.

Financial Performance

Apple has shown impressive financial results, with a Return on Assets (ROA) of 17.73% and Return on Equity (ROE) of 73.69% in 2020.

Microsoft has also performed well, with strong growth in cloud services driving its financial success.

Marketing and Brand Image

Apple's marketing focuses on emotion, lifestyle, and user experience, creating a strong brand identity and loyal customer base.

Microsoft has traditionally focused on functionality and business applications, but has made efforts to improve its consumer brand image in recent years.

The contrasting approaches of these tech giants offer valuable lessons for B2B companies:

Innovation is key: Both companies invest heavily in R&D, demonstrating the importance of continuous innovation in maintaining market leadership.

Adapt or perish: Microsoft's shift under Nadella shows how even established companies can reinvent themselves to stay relevant.

Brand matters: Apple's success highlights the power of strong branding and emotional connection with customers, even in the B2B space.

Ecosystem strategy: Companies must decide whether a closed, integrated ecosystem or an open, partnership-based approach best suits their products and market.

Culture drives success: Both companies demonstrate how corporate culture can either hinder or drive innovation and market success.

As the tech landscape continues to evolve, Apple and Microsoft's rivalry showcases the importance of balancing innovation, market strategy, and corporate culture. Their ongoing competition continues to drive advancements in technology, benefiting consumers and businesses alike.

Nike vs. Adidas

In sportswear, Nike and Adidas stand as two titans in perpetual competition. This rivalry has elevated the entire sports apparel industry through product design, marketing, and athlete endorsements.

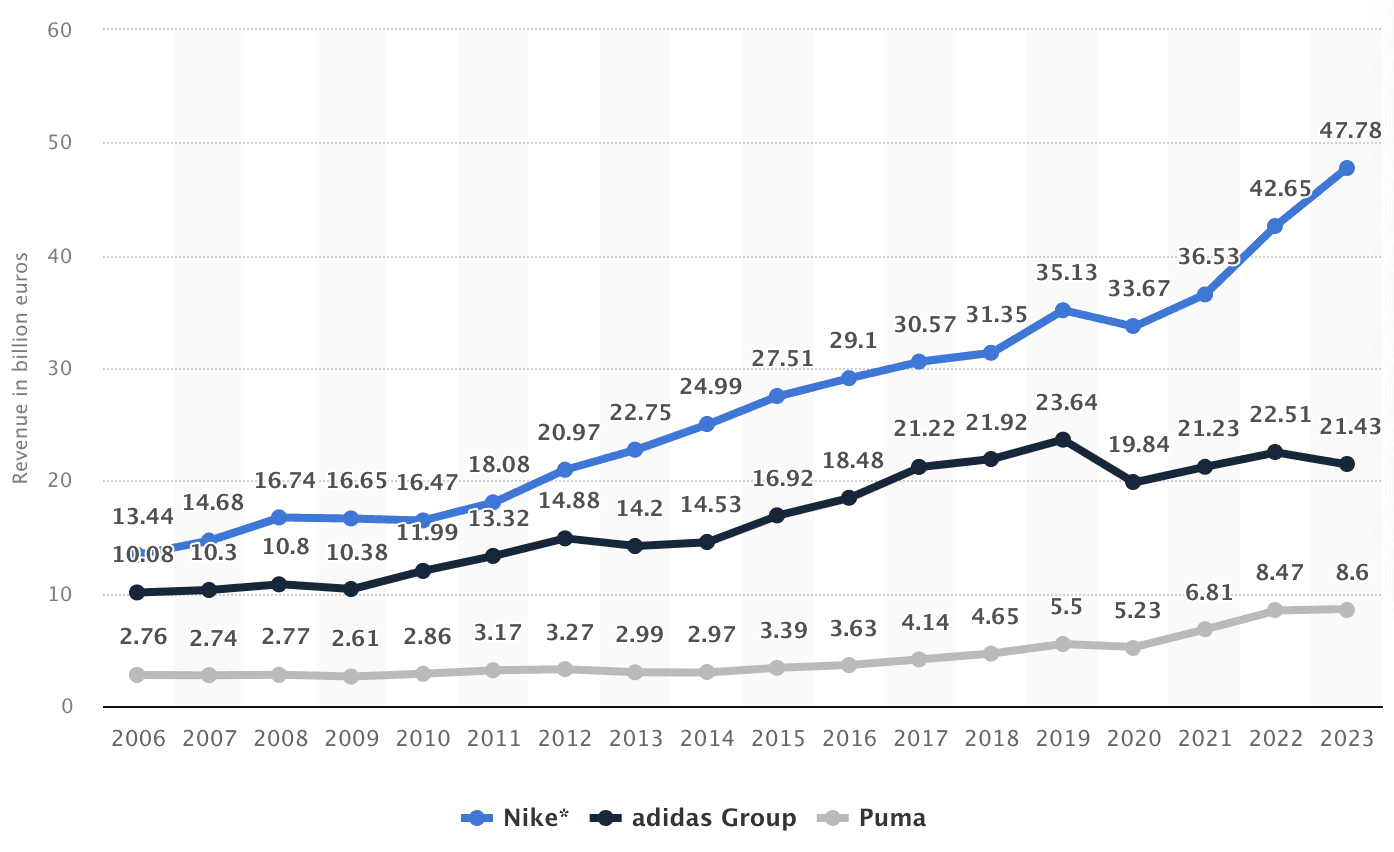

(Source: Statista)

Nike has significantly widened its lead over Adidas in recent years. In 2023, Nike reported global revenue of €47.78 billion, compared to Adidas' €21.43 billion. This gap has grown substantially since the mid-2000s when the two were much closer in revenue. Nike's consistent growth (12% from 2022 to 2023) contrasts with Adidas' relatively flat performance since 2020.

Nike vs. Reebok

While often overshadowed by the Nike-Adidas rivalry, Nike's competition with Reebok in the 1980s and 1990s was equally intense, particularly in the aerobics and fitness market. This rivalry showcased how competition in a specific market segment can drive innovation and market expansion.

Sotheby's vs. Christie's

In the fine art auction world, Sotheby's and Christie's have been fierce competitors for centuries. Their rivalry has shaped the global art market, influencing trends, prices, and the way art is bought and sold.

Duracell vs. Energizer

The battery battle between Duracell and Energizer exemplifies how rival companies can drive product innovation and creative marketing. Their competition has spurred advancements in battery technology and sustainability efforts.

Ferrari vs. Lamborghini

The rivalry between Ferrari and Lamborghini is a tale of passion, engineering prowess, and Italian flair that has captivated automotive enthusiasts for decades. This fierce competition has driven innovation, pushed technological boundaries, and redefined the supercar landscape.

The saga began in 1963 when Ferruccio Lamborghini, a successful tractor manufacturer, approached Enzo Ferrari with a complaint about his Ferrari's clutch. Legend has it that Ferrari dismissively told Lamborghini to stick to making tractors, uttering the now-famous words, "Let me make cars. You stick to making tractors."

This rejection sparked a fire in Lamborghini. As he later recalled, "Mechanics was in my blood and I knew I could beat Ferrari." True to his word, Lamborghini set out to create his own luxury sports car company, aiming to build "the best super sports car ever."

Ferrari, founded in 1939 by Enzo Ferrari, had already established itself as a premier racing and luxury sports car brand. The company's DNA was deeply rooted in Formula One, focusing on delivering a driving experience as close to a race car as possible. On the other hand, Lamborghini aimed to create cars that were not just fast but also comfortable and well-designed.

The contrast in their approaches is evident in their design philosophies. Ferrari's cars speak of aerodynamics, speed, and an aggressive racing stance, while Lamborghinis are known for their bold and avant-garde designs, epitomized by the iconic scissor doors of the Countach and Murciélago.

Both companies have pushed the envelope in terms of performance and innovation. Ferrari's expertise in engines and aerodynamics has led to some of the most powerful and fastest cars in the world. The Ferrari 488 GTB, for example, is a testament to the brand's commitment to innovation, featuring a turbocharged engine that balances power with efficiency.

Lamborghini's approach to performance is equally impressive. The Aventador, with its V12 engine, represents the pinnacle of Lamborghini's engineering, offering a perfect blend of raw power and technological sophistication.

In terms of market presence, both brands have carved out their niches in the luxury car market. Ferrari has consistently maintained exclusivity by limiting production numbers, ensuring high demand for its cars. Lamborghini, while also focusing on exclusivity, has been slightly more aggressive in its production strategy, as evidenced by the introduction of models like the Urus SUV.

The rivalry has had its ups and downs. During the 1970s oil crisis, both companies faced significant challenges. The supercar market shrank by 80% in just one year, forcing Lamborghini to sell his company. Ferrari, while also affected, managed to weather the storm better due to its established brand and racing pedigree.

In motorsport, Ferrari's legacy is unrivaled. As a staple in Formula One since its inception, Ferrari has won numerous championships and is a beloved team worldwide. Lamborghini's involvement in motorsport has been more restrained, focusing on GT racing and the Lamborghini Super Trofeo.

Today, both companies continue to innovate and compete. Ferrari is actively working towards unveiling its first all-electric car by 2025, positioning itself ahead of Lamborghini in terms of groundbreaking advancements. Meanwhile, Lamborghini continues to push boundaries with models like the hybrid Sián FKP 37.

The Ferrari-Lamborghini rivalry demonstrates how competition can drive innovation and excellence in an industry. As Ferruccio Lamborghini once said, "When you stop working you start to die." This relentless pursuit of perfection, sparked by a heated exchange between two passionate entrepreneurs, has given the world some of the most extraordinary vehicles ever created.

For B2B companies, this rivalry offers valuable lessons in the power of competition to drive innovation, the importance of brand positioning, and the impact of visionary leadership in shaping an industry. It also highlights how a newcomer with a fresh perspective can disrupt an established market, forcing incumbents to innovate and adapt.

Netscape vs. Microsoft

The clash between Netscape and Microsoft in the mid-1990s, known as the "Browser Wars," reshaped the internet landscape and offers valuable lessons in business strategy and negotiation.

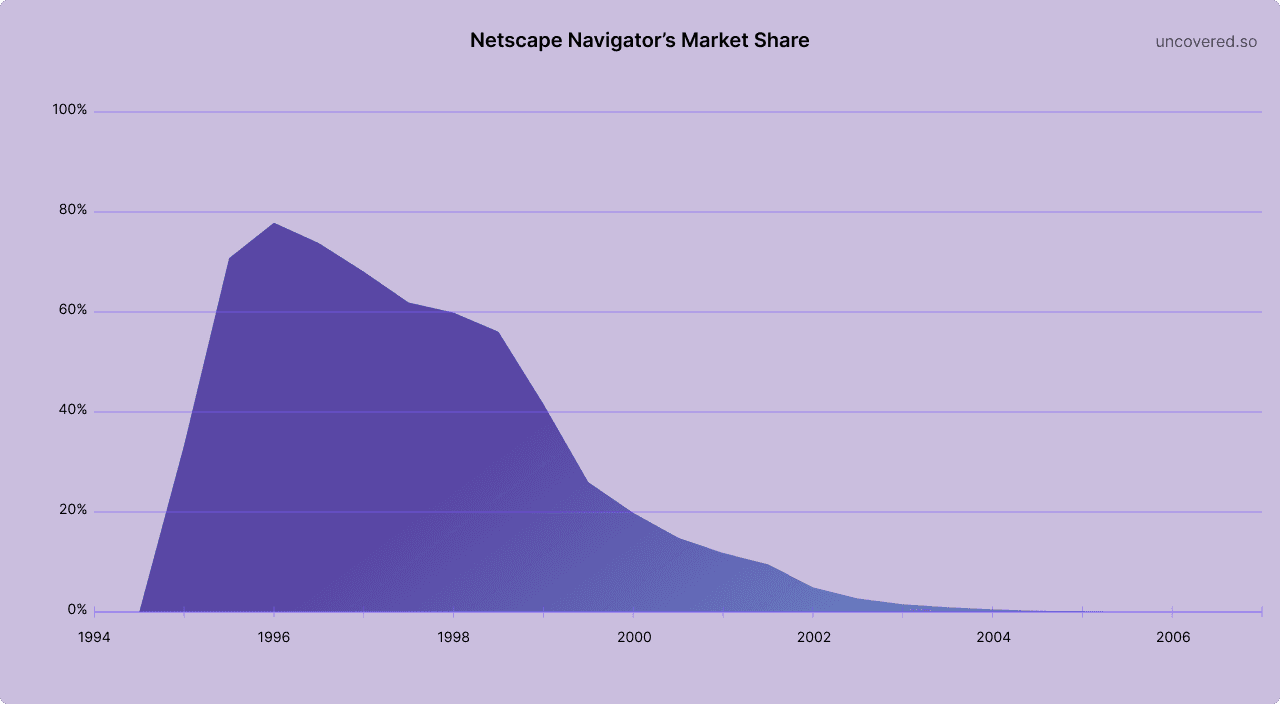

Netscape Navigator burst onto the scene in 1994, quickly dominating the nascent browser market with its user-friendly interface and innovative features. By 1995, Netscape commanded an impressive 80% market share. The company's August 1995 IPO was a resounding success, with stock prices soaring from $28 to $75 on the first day of trading, valuing the company at nearly $3 billion.

Microsoft, caught off guard by the internet's explosive growth, initially lagged behind. However, Bill Gates, recognizing the potential threat to Windows' dominance, quickly pivoted the company's strategy. In his famous "Internet Tidal Wave" memo of May 1995, Gates declared that Microsoft must "match and beat" Netscape.

The ensuing battle was as much about business acumen as it was about technology. While Netscape had the superior product, Microsoft leveraged its market position and negotiation skills to gain the upper hand. A pivotal moment came in 1996 when both companies vied for a deal with AOL, then a major internet service provider.

Netscape, confident in its market dominance, took a hard line in negotiations. They demanded a high per-copy fee for their browser, adopting a "browser for dollars" approach. As Steve Case, AOL's CEO, later recalled,

"They [Netscape] were very aggressive about selling the browser, but they wanted a very high per-copy fee. The attitude was, 'We're so hot, we'll license to everyone, so you better take it'."

Microsoft, despite having a technically inferior product and minimal market share, outmaneuvered Netscape with a creative negotiation strategy. Instead of focusing on technology, they leveraged their marketing strength. Microsoft offered to bundle AOL with Windows for free and promised additional technical adaptations for a multi-year contract.

This masterstroke changed the game. As David Colburn, AOL's chief negotiator, stated, "The willingness of Microsoft to bundle... with the Windows operating system was a critically important competitive factor that was impossible for Netscape to match." AOL gained access to what they called "the most valuable desktop real estate in the world," reaching an additional fifty million people per year at zero cost.

Microsoft's strategy, while sacrificing some short-term market share to AOL, achieved the larger goal of gaining a foothold in the browser market. This deal exemplifies how creative negotiation can turn a weak position into a winning one.

The Browser Wars escalated further as Microsoft began bundling Internet Explorer with Windows, leveraging its operating system dominance to push its browser. This tactic eventually led to antitrust litigation against Microsoft, but not before it had severely undermined Netscape's market position.

By 1998, Netscape's market share had plummeted, and the company was acquired by AOL for $4.2 billion. However, Netscape's legacy lived on through the Mozilla project, which eventually gave rise to Firefox.

The Netscape vs. Microsoft rivalry demonstrates how market dynamics can shift rapidly in the tech industry. It underscores the importance of adaptability, strategic negotiation, and leveraging one's strengths - even when they're not directly related to the product at hand. For B2B companies today, this case study offers valuable lessons in competitive strategy and the dangers of complacency in a fast-moving market.

Visa vs. MasterCard

In electronic payments, Visa and MasterCard have been locked in competition for decades. Their rivalry has driven innovations in payment technology, from chip cards to contactless payments, shaping the global financial landscape.

Airbus vs. Boeing

The rivalry between Boeing and Airbus represents one of the most intense and long-standing duopolies in the business world. These two aerospace giants have been locked in a fierce competition that has shaped the commercial aircraft industry for decades.

Boeing, founded in 1916 in Seattle, Washington, has a rich history of innovation in aviation. The company pioneered many firsts, including the first modern passenger airliner (Model 247 in 1933) and the first airliner with a pressurized cabin (Model 307 Stratoliner in 1947). Boeing's 737 family, introduced in 1967, went on to become the best-selling commercial aircraft in history.

Airbus, on the other hand, was formed in 1970 as a European consortium to compete with American dominance in the aerospace industry. The company quickly made its mark with the introduction of the A300 in 1972, the world's first twin-engine widebody airliner.

The competition between these two companies has driven significant innovations in aircraft design, fuel efficiency, and passenger comfort. Boeing's expertise in engines and aerodynamics has led to some of the most powerful and fastest commercial aircraft, such as the 787 Dreamliner. Airbus, meanwhile, has focused on fuel efficiency and passenger experience, exemplified by their A350 XWB (Extra Wide Body).

In terms of market strategy, both companies have distinct approaches:

Target Markets: Boeing has traditionally had a strong presence in North America, while Airbus has focused on Europe and has successfully expanded into Asia, particularly China. Boeing targets a wide range of customers, including legacy carriers, low-cost airlines, and military organizations. Airbus concentrates more on commercial airlines and has made significant inroads with low-cost carriers.

Product Positioning: Boeing emphasizes its competitive edge in fuel efficiency, operating costs, and passenger experience. Airbus positions itself as a leader in long-haul flight capabilities and innovative design features.

Pricing Strategies: Boeing often offers competitive pricing and discounts to secure deals with strategic customers. Airbus, while also competitive, tends to rely more on the perceived value and uniqueness of its products to justify its pricing.

Innovation: Both companies invest heavily in R&D. Boeing's focus on continuous improvement has led to advancements like the composite materials used in the 787 Dreamliner. Airbus has been at the forefront of incorporating AI and automation in their aircraft design and manufacturing processes.

Sustainability: With growing concerns about climate change, both companies are investing in developing more fuel-efficient and environmentally friendly aircraft. Airbus has announced plans for zero-emission commercial aircraft by 2035, while Boeing is focusing on sustainable aviation fuels.

The rivalry has had its ups and downs. Boeing's 737 MAX crisis in 2019 led to a significant shift in market dynamics, allowing Airbus to overtake Boeing in deliveries and orders for the first time in a decade. However, both companies faced challenges during the COVID-19 pandemic, with a sharp decline in aircraft deliveries in 2020.

As of 2023, the competition remains fierce. In February 2023, Air India placed the largest aircraft order in aviation history, split between Boeing (220 aircraft) and Airbus (250 aircraft), demonstrating the ongoing battle for market share between these two giants.

The Boeing-Airbus rivalry showcases how intense competition can drive innovation and progress in an industry. For B2B companies, this case study offers valuable lessons in the importance of continuous innovation, strategic market positioning, and the ability to adapt to changing market conditions and customer needs.

McDonald's vs. Burger King

In fast food, the McDonald's-Burger King rivalry has driven menu innovations, marketing strategies, and global expansion efforts. From the Big Mac to the Whopper, their competition has produced some of the most iconic fast-food items and advertising campaigns in history.

HP vs. IBM

The rivalry between HP and IBM in computer hardware and IT services has been a defining feature of the tech industry for decades. Their competition has driven innovations in personal computing, enterprise hardware, and IT consulting services.

Ford vs. GM

The automotive industry in America has long been defined by the Ford-GM rivalry. This competition has driven innovations in car design, manufacturing processes, and marketing strategies, shaping the entire automotive landscape.

Oracle vs. Microsoft

Oracle and Microsoft's rivalry has been the stuff of tech industry legend for decades. This clash of titans, personified by Oracle's firebrand co-founder Larry Ellison and Microsoft's leadership, has fueled a relentless drive for innovation in database technology, cloud services, and enterprise applications.

Larry Ellison's competitive spirit is perhaps best captured by his infamous quote: "It's not enough that we win; all others must lose." This win-at-all-costs mentality shaped Oracle's aggressive approach, particularly in its battles with Microsoft. In fact, a 1998 CNN report revealed that Ellison's competitiveness ran so deep, he once hired private investigators to dig up dirt on Microsoft-funded trade organizations.

The intensity of this rivalry is further illustrated by a telling anecdote from former Microsoft CTO Nathan Myhrvold. In a 1997 Vanity Fair interview, Myhrvold remarked,

"I mean, the guy's got six billion bucks. You'd think he wouldn't be so dramatically obsessed that one guy in the Northwest is more successful. [With Larry] it's just a mania."

As the new millennium dawned, Oracle and Microsoft were locked in a fierce battle for database market supremacy. Oracle's powerful relational database management system dominated the landscape, while Microsoft aggressively pushed its SQL Server as a user-friendly alternative.

Oracle vs. Salesforce

The rivalry between Oracle and Salesforce in customer relationship management (CRM) and cloud services has been intense and public. Their competition has driven innovations in cloud-based enterprise software and shaped how businesses manage customer relationships and data.

Nvidia vs. Intel

In the semiconductor industry, the Nvidia-Intel rivalry has intensified in recent years. While Intel has long dominated in CPUs, Nvidia's strength in GPUs has become increasingly important in the age of AI and machine learning.

How Intensity of Rivalry Shapes Market Strategies

The intensity of these rivalries profoundly impacts market strategies. Companies locked in fierce competition often push each other to innovate faster, improve quality, and offer better value to consumers. This rivalry-driven innovation can lead to rapid advancements in technology, improved products, and more choices for consumers.

As David Sarnoff aptly put it, "Competition brings out the best in products and the worst in people." While rivalry drives product innovation, it can also lead to unethical behavior as companies fight for market share.

Intense competition shapes pricing strategies, marketing approaches, and even corporate culture. Companies may invest heavily in R&D to stay ahead or focus on cost-cutting to offer more competitive prices. Some rivalries lead to aggressive marketing campaigns, while others result in legal battles over patents and market share.

The intensity of rivalry often determines the pace of industry evolution. In fast-moving sectors like technology, intense competition can lead to rapid product cycles and constant innovation. In more established industries, rivalry might focus more on brand loyalty and customer experience.

Benefits of Healthy Competition in Business Ecosystems

Healthy competition in business ecosystems drives innovation, improves quality, keeps prices in check, and expands consumer choice. It creates a dynamic environment where businesses are constantly challenged to improve and innovate, resulting in better outcomes for consumers and the market as a whole.

Herbert Hoover emphasized this point: "Competition is not only the basis of protection to the consumer, but is the incentive to progress." This quote underscores how competition benefits consumers and drives companies to continually improve and innovate.

Innovation and Quality Improvement Driven by Competition

Competition is a powerful catalyst for innovation and quality improvement. When businesses compete for customers, they're compelled to differentiate themselves through superior products, services, or experiences. This drive for differentiation often leads to groundbreaking innovations and significant improvements in product quality.

William J. H. Boetcker highlighted this concept: "Without competition we would be clinging to the clumsy antiquated processes of farming and manufacture and the methods of business of long ago, and the twentieth would be no further advanced than the eighteenth century." This quote underscores how competition drives innovation and technological progress across industries.

57% of businesses consider gaining a competitive edge as one of their top three goals. To achieve this edge, businesses invest heavily in research and development, seeking novel solutions to customer problems or unmet needs. While incumbents may have deeper pockets, successfully implementing innovations often proves more challenging than merely funding R&D efforts.

Impacts on Pricing and Consumer Choice

Competition plays a crucial role in how businesses compete for customers, particularly in terms of pricing and consumer choice. In a competitive market, companies are incentivized to offer the best possible value to attract and retain customers. This often results in more favorable pricing for consumers and a wider array of options to choose from.

Ayn Rand offered an interesting perspective on this: "Competition is a by-product of productive work, not its goal. A creative (wo)man is motivated by the desire to achieve, not by the desire to beat others." This suggests that healthy competition should focus on creating value for consumers rather than just beating rivals on price.

When multiple competitive businesses vie for market share, they're often forced to keep their prices in check. If one company raises prices too high, customers have the option to switch to a competitor offering similar products or services at a lower cost.

Competition fosters diversity in product offerings. As businesses seek to carve out their niche in the market, they often develop unique features or variations of products to appeal to different consumer segments. This results in a broader range of choices for consumers, allowing them to find products that best suit their specific needs and preferences.

The importance of staying competitive is evident in the fact that 94% of companies intend to invest in competitive intelligence. This investment in understanding the competitive landscape allows businesses to make informed decisions about pricing, product development, and market positioning, ultimately benefiting consumers through better products and services.

Lessons from History: How Past Rivalries Influence Present Strategies

The annals of business history are replete with tales of fierce rivalries and epic business battles. These historical competitive landscapes offer valuable insights that shape modern business strategies. By examining past business rivalry examples and conducting thorough business competitors analysis, companies can gain a competitive edge in today's fast-paced market.

Analyzing Historical Business Battles to Predict Future Trends

Studying past business rivalries provides a wealth of information for competitive analysis in marketing plans. These historical case studies offer lessons on successful strategies, pitfalls to avoid, and the long-term impacts of various competitive approaches. By understanding how past companies navigated their competitive landscapes, modern businesses can better prepare for future challenges.

One striking statistic underscores the importance of this historical analysis: 20% of startups fail because their competitors can overtake them. This highlights the critical need for businesses to stay ahead of the competition and continuously innovate.

42% of small businesses that fail within the first five years do so because there isn't enough customer demand. This statistic emphasizes the importance of not just focusing on challenging competitors, but also on understanding and meeting customer needs.

Competing businesses examples from the past, such as the rivalry between VHS and Betamax or the browser wars between Netscape and Microsoft, offer insights into how technological shifts can rapidly change market dynamics. These cases demonstrate the importance of adaptability and the dangers of complacency in the face of changing consumer preferences or technological advancements.

The intensity of modern competition is evident in the fact that 90% of businesses say that their industry has become more competitive in the last three years, with 48% saying it has become much more competitive. This statistic underscores the need for businesses to continuously refine their competitive strategies and stay alert to market changes.

By analyzing historical business battles, companies can:

Identify successful competitive strategies that have stood the test of time

Recognize early warning signs of market shifts or disruptive innovations

Understand the long-term consequences of different competitive approaches

Learn from past mistakes and avoid repeating them

Anticipate potential future challenges based on historical patterns

For instance, the rivalry between Coca-Cola and Pepsi offers lessons in brand positioning and marketing strategy that are still relevant today. The competition between Apple and Microsoft provides insights into the importance of ecosystem development and user experience in the tech industry.

Looking to the future, businesses can use these historical lessons to predict and prepare for upcoming trends. For example, the current rivalry between traditional automakers and electric vehicle manufacturers echoes past technological disruptions. By studying how industries have previously adapted to such shifts, companies can better position themselves for future changes.

In conclusion, analyzing historical business rivalries is not just an academic exercise; it's a crucial component of modern competitive strategy. By learning from the successes and failures of past competing businesses, today's companies can develop more robust strategies, anticipate market changes, and stay ahead in an increasingly competitive business landscape.

As Henry Ford wisely noted, "The competitor to be feared is one who never bothers about you at all, but goes on making his own business better all the time." This quote highlights how healthy competition motivates companies to focus on self-improvement rather than just reacting to rivals – a lesson that remains as relevant today as it was in Ford's time.

Share post: